A warm welcome to the Deeper newsletter, dear reader!

You’re reading this because, just like us, you’re tired of the non-stop tech and startup news cycle, where there seems to be something new and trendy to keep up with in Southeast Asia.

What you want to know about is the important stuff that matters—period.

And that’s what we’re bringing to you. We’ll dive deep into a trending topic in Southeast Asian tech, and their impact on society (i.e. me and you).

Sound compelling? Subscribe now, and we’ll send it straight to your inbox:

Without further ado, let’s dive in.

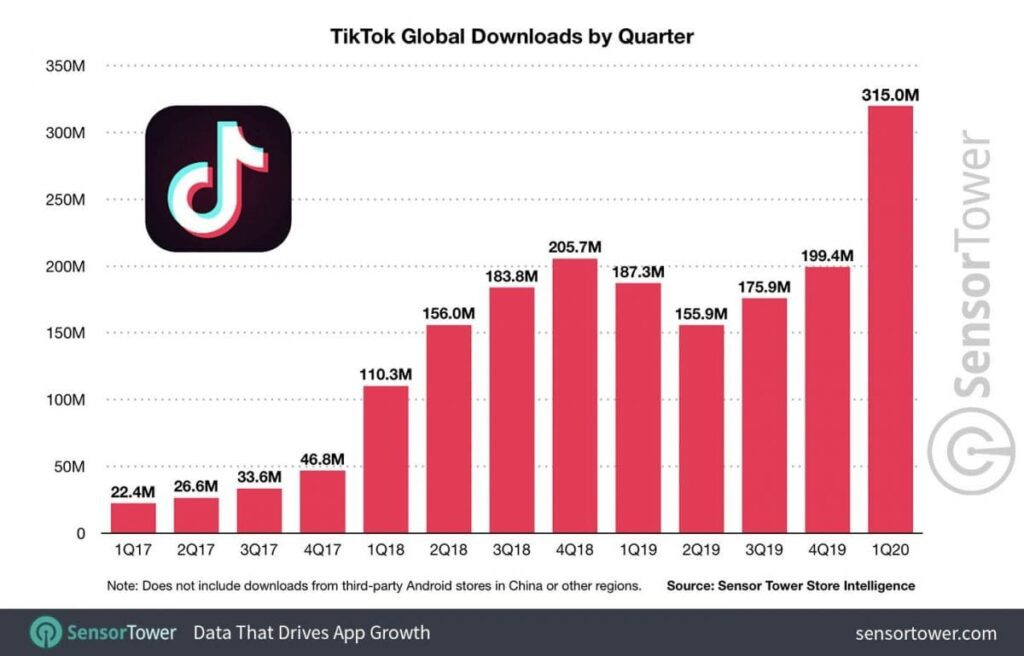

According to app analytics firm Sensor Tower, TikTok crossed 2 billion all-time global downloads across iOS and Android devices in April 2020. The app saw a record 315 million installs in Q1 alone—the most downloads any app has ever seen in a single quarter. Thanks, COVID-19. (For reference, there are only 7.8 billion people on the planet right now).

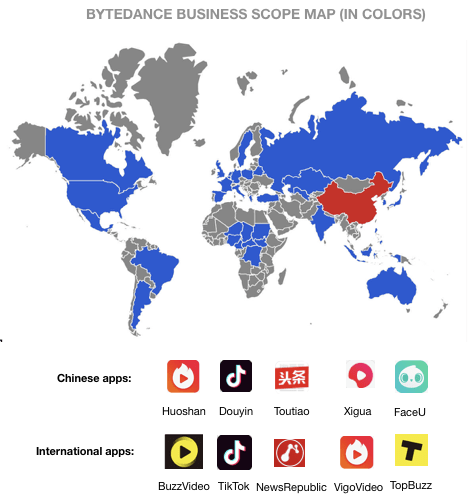

TikTok’s rise to mainstream culture isn’t as sudden as it seems. ByteDance, its parent company, has been preparing for years to become the most influential company in the world.

TL;DR: The company will impact entire countries and continents in much the same way its competitors—Apple, Google, Amazon, Alibaba, and Tencent—have.

- ByteDance, a tech giant set to compete with the other greats

- TikTok’s strategies for gaining revenue internationally

- ByteDance’s recommendation engine can be applied to nearly any vertical

- Three main obstacles: content moderation, data regulation laws, and anti-Chinese sentiment

- ByteDance is selling innovation

- Manifesting its destiny as a major tech giant, for better or worse

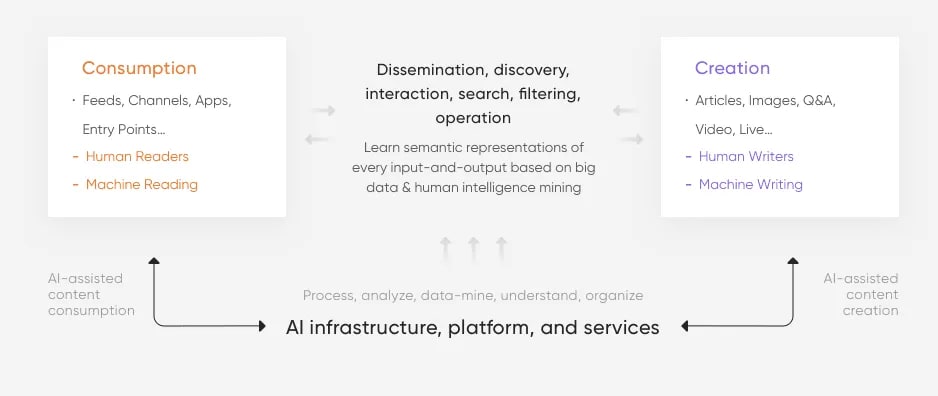

The key to ByteDance’s success is its machine learning, which squeezes insights out of the millions of data points it tracks across all its services. This results in a highly flexible, agile, and iterative company that grows and metamorphoses right alongside its user base.

ByteDance, a tech giant set to compete with the other greats

To understand TikTok, we first have to understand ByteDance, the Chinese multinational internet technology company that owns the app. ByteDance was founded by engineer Zhang Yiming in 2012, and it is currently worth over US$100 billion—making it one of the most valuable companies in the world. Much like Google, it operates multiple types of apps and platforms designed to one day interconnect and build off of each other—but more on that later.

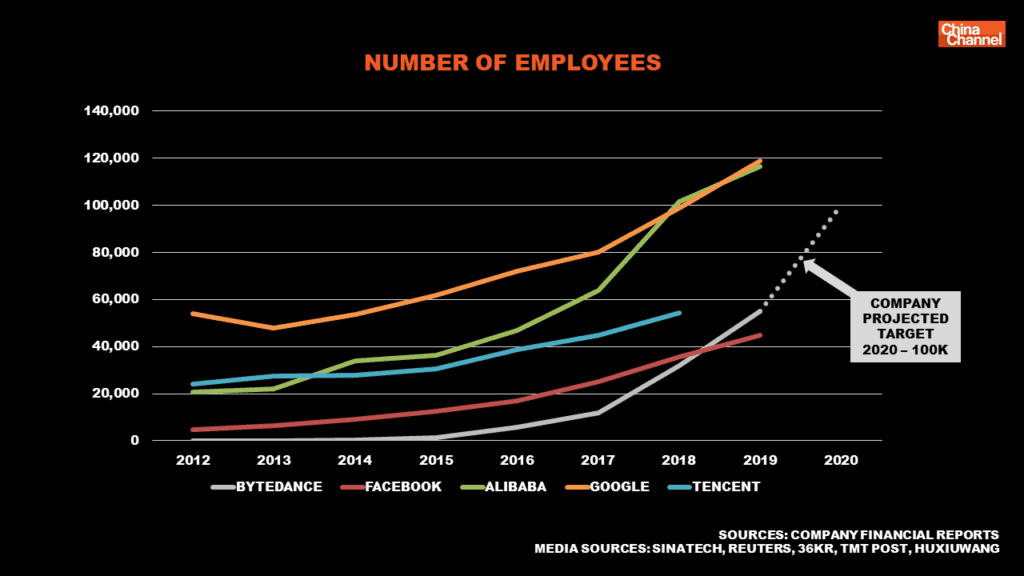

ByteDance announced plans to create 40,000 new jobs in 2020, and it looks like the Chinese startup is well on track to hit those numbers. At a time when other companies are furloughing or laying off staff, ByteDance is recruiting for 10,000 open positions—a third of which are high-level research or software coding jobs. This would bring its overall headcount to 100,000.

The company’s core product—before TikTok, anyway—was Toutiao, a highly-diverse content platform that started off as a Chinese news aggregator. A machine-learning algorithm constantly feeds texts, images, question-and-answer posts, microblogs, news articles, and videos based on its analysis of your reading preferences.

But Toutiao wasn’t the only successful app in ByteDance’s portfolio at that time. Before TikTok ever appeared on the scene, ByteDance was already managing the successful Douyin app (basically the same thing as TikTok, but solely for China). A year after its September 2016 launch, Douyin had 100 million users and numerous collaborations with top Chinese stars—reportedly, users viewed a collective 1 billion videos a day.

Seeing the massive success in China, ByteDance launched TikTok for an international market in September 2017.

ByteDance was smart about international plans for expansion. The company spent up to $1 billion to purchase musical.ly, an app that was mostly known for its cringe content of over-confident teenagers attempting sexy selfie karaoke.

Despite its poor reputation among older users, musical.ly had grown its user base to 90 million users in just two years—according to Alex Hofmann, president of Musical.ly North America, half of all American teenagers had the app installed in 2016. It reached number one on Apple’s App Store in 19 different countries. For ByteDance, which had set its sights on TikTok world domination from the beginning, the musical.ly merger was a no-brainer.

TikTok’s strategies for gaining revenue internationally

TikTok gained even more users this year, so the company reduced its budget for marketing + growing the app’s user base. It’s spent much of its time exploring possible revenue sources instead.

Unlike US-based content companies, which have historically clung to the subscription model, ByteDance is willing to try many different ways of making its properties profitable.

Ecommerce integration in TikTok videos

Ecommerce integration–with links to shoppable products—has already been available in Douyin since 2018 (Taobao, JD, and TMall are all good). ByteDance may try to build partnerships with local ecommerce platforms like Shopee, Shopify, Lazada, or Tokopedia, or follow Instagram’s steps and introduce e-commerce stickers with links to shoppable websites.

Long-form video subscriptions on TikTok or a new app?

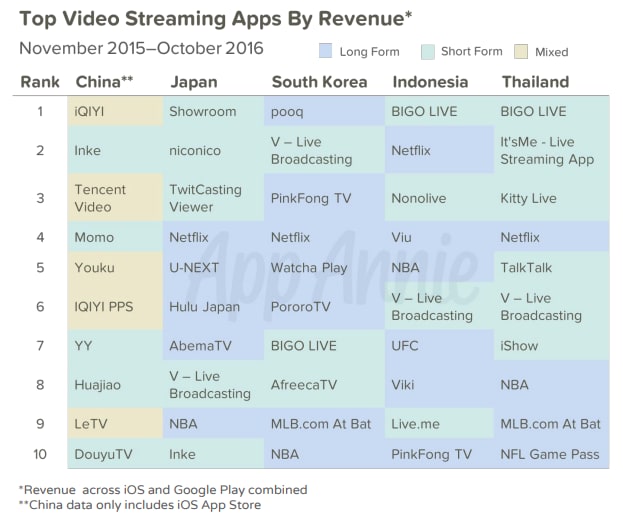

Concerts and music gatherings have been cancelled around the world thanks to COVID-19. As a result, many entertainment giants are attempting to foray into long-form video streaming.

Asian-American record label 88Rising hosted a live-streamed benefit concert on Youtube on May 7th, bringing Coachella stars and Kpop acts such as Rich Brian, Joji, and Loona to an audience of nearly 2 million people. The five-hour stream raised $28,706 through donations from viewers.

Korean idol group BTS previously hosted an online Bang Bang Con in April, showing archival live footage from their concerts around the world to devoted fans. Their livestream gained more 50 million views and, at one point, 2 million concurrent viewers.

In response, Tiktok hosted two vertical, live-streamed benefit concerts of their own: TikTok Stage Live From Seoul (May 25) and TikTok Stage With HIPHOPPLAYA (May 27), with a lineup that included Kpop industry giants like Monsta X, iKon, Apink, Epik High, Jay Park, and Zico. According to one official statement, TikTok agreed to donate US$0.50 (S$0.70) for every viewer who tuned in, with all funds going towards COVID-19 charity efforts.

Recently, ByteDance also brought on Kevin Mayer, the ex-Head of Disney+, as its new COO / CEO of TikTok. Mayer grew Disney’s new subscription service to over 50 million users in less than a year and also led many of Disney’s acquisitions over the past decade, including Marvel, Lucasfilm, Pixar, 21st Century Fox, and Club Penguin. He will be leading the music, gaming, and “emerging” businesses at the company.

Combined with its forays into online concerts and increased upload limits (from 15 seconds to 1 minute to 15 minutes), expect TikTok to place an increasing emphasis on all types of vertical video content—from original content to self-produced series to hosted vertical concerts. It might even go head to head with Netflix or Disney+ one day.

TikTok as a marketing platform

For now, many advertisers are still unsure of how much money to pour into TikTok. Jeremy Ong, founder of content marketing agency Hustlr, told Tech in Asia that TikTok’s machine-learning algorithm and user behavior-tracking capabilities were not yet as mature as those of Facebook and Google—so it may still be too early to look for measurable outcomes like sales, web and app conversions, in-store visits and lead generation.

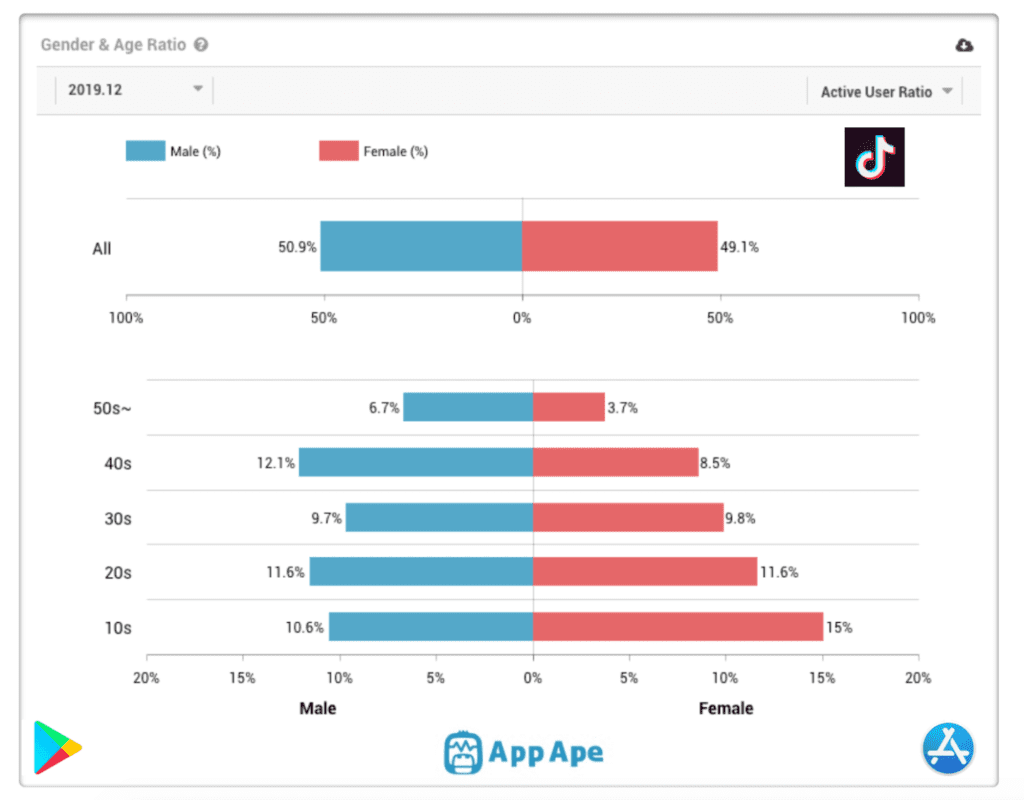

Additionally, the app’s user base tends to skew young, which translates to limited buying power in the short term—41 percent of TikTok users are aged between 16 and 24.

On this end, it’s a wait-and-see game. For example, a recent increase in older users over the past several months may make the platform much more attractive to advertisers.

After all, Douyin has been successful in China, making about 140 billion yuan ($19.8 billion) in advertising revenue in 2019.

Despite some pessimism, all signs seem to point to TikTok becoming a respectable ad platform.

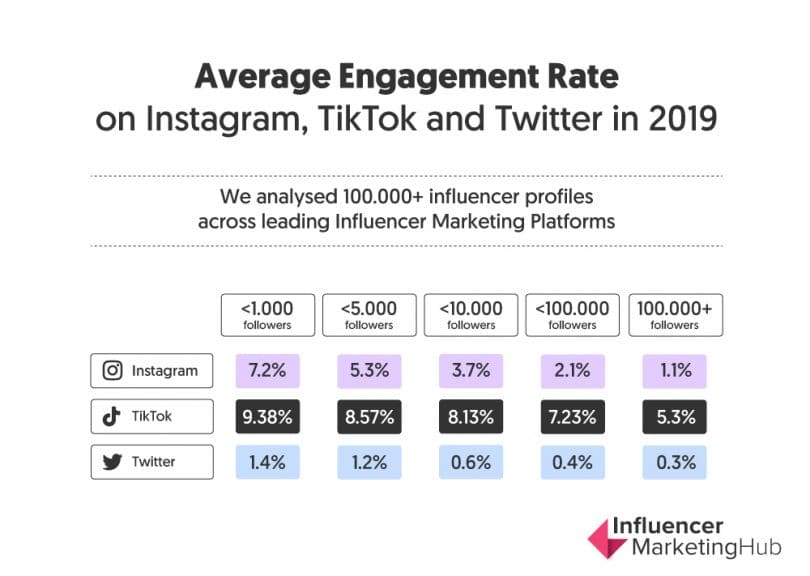

“In many categories, it outstripped Tencent (TCEHY) and Baidu (BIDU) to become the #1 advertising platform” in China, said Greg Paull, a principal with R3. Its relatively high engagement rates are a positive indicator that it will be able to overtake other social media platforms to become the influencer platform of choice:

If you’re looking to advertise on TikTok, we recommend waiting until it refines its advertisement platform and offers the measurable insights you need into campaigns. That’s a matter of how soon, not if.

ByteDance is selling innovation

ByteDance is a numbers-fueled, A/B-testing-based company that is hyper-tailored to user demands. Create an initial product, stalk the data, introduce new features, rinse-and-repeat—high-performing projects get more funding and more support, whereas the poor performers are scrapped. It’s innovation at the speed of light, and for a company of that size, completely impressive.

Rather than limiting users to friend networks or geographical boundaries, ByteDance seeks to turn the entire world into a captive audience by understanding their behavioral patterns and building apps to fit those needs perfectly.

All of this is made possible through the company’s research arm—led by former assistant managing director of Microsoft Research Asia Wei Ming Yi. The division studies areas such as natural language processing, machine learning, and speech and audio recognition, and the knowledge it gleans helps improve content recommendation algorithms. ByteDance is all about constant refinement.

Innovation is even present in its company structure

According to a report by The Information, the company has a unique flat-corporate structure means product managers can report directly to Zhang.

Such an agile structure might seem like chaos for other companies relying on traditional hierarchy, but it seems to have worked well for Bytedance. As of November last year, the company has over 60,000 employees and serves over 150 markets. It also has offices in 126 cities around the planet, including Shanghai, New York, London, Paris, Mumbai, Singapore, Jakarta, Seoul, and Tokyo.

The firm’s army of employees is becoming increasingly active in other spaces, like enterprise software, edtech, and gaming.

- Launched enterprise communication platform Lark in Singapore and Japan last year (called Feishu in China) at slashed prices, hoping to refine the platform further based on user behavior.

- Released Volcano Engine, an enterprise cloud services platform with nine functions including live video broadcasts, real-time communication, and video conferencing, in early 2020.

- ByteDance’s “Combat of Hero” game topped download charts in Japan for four straight days, and should momentum grow, we can expect the firm to add more hires here as well.

- Experimented with event ticketing by launching TikTok Tickets in Thailand. The temporary program ran throughout Q4 2019 and offered deals and discounts to users buying tickets to over 500 concerts, movies and other events. Lots of data on event preferences.

- Released social music streaming app Resso in India and Indonesia earlier this year. Currently Resso has been downloaded up to 600,000 times in India, but if it can piggyback off TikTok’s success through direct links to Resso tracks, that number may go up significantly.

- Across all of its apps in China and abroad, it has amassed around 1.5 billion monthly active users.

Each and every one of these products can be further refined and optimized based on insights gleaned from big data. Sure, it has some failures:

Duoshan, a video-based messaging app that ByteDance designed to compete with the WeChat messaging service in China, flopped after its rollout. And a failed digital payments app tried to gain market share from Tencent Holdings Ltd. ‘s WeChat Pay and Ant Financial Services Group’s Alipay and failed.

But it may not even matter—to ByteDance, it means that opportunity simply lies elsewhere.

Three main obstacles: content moderation, data regulation laws, and anti-Chinese sentiment

Content moderation

ByteDance’s algorithms amplify popular content, but often, what’s popular isn’t always good. The TikTok app has drawn ire in India after sexually explicit and vulgar videos advocating rape, animal cruelty, child abuse, domestic violence and misogyny gained traction on the platform, causing people to push for a total ban on the app.

Users flooded the app’s page with negative reviews, causing the rating to fall from 4.5 stars to 1.2. Even after Google removed millions of negative reviews (marked as spam abuse), the rating still hasn’t risen past the 2 star mark.

Moderation has always been an issue with social media platforms, with Facebook moderators being worked into the ground to keep negative content away from users and Instagram trying a variety of tactics to ban abusive or unhealthy content.

We could argue that the type of content gaining popularity in different regions is reflective of 1) the local attitudes towards contentious topics and 2) the desire to gain eyeballs no matter the cost. But regardless of why that type of content was created, its presence will continue to be a major problem for TikTok.

This poses an obstacle to its plans for expansion

Livestreaming works in China, but it’s had difficulty gaining traction in Southeast Asian markets. Top livestreaming app BIGO was blamed for fuelling a sugar daddy boom and even called a social media prostitution platform thanks to the high amount of sexually-suggestive content. It was temporarily banned in Indonesia out of fear that it was leading young viewers astray.

Even alternative BeLive, which attempted to poach creators by promising a safer ecosystem, eventually pivoted from a consumer-focused live-streaming model to providing live video services for global e-commerce companies such as Rakuten, Loreal, Lazada, and Samsung. This barrier is a cultural one, and it won’t be easy to warm the rest of the world up to live streaming as a source of revenue.

Data regulation concerns

ByteDance’s obsession with data is creating regulatory problems in the countries where it hopes to expand. Its business activities have been banned or investigated in many countries—including China.

USA Senator Marco Rubio has asked regulators to review ByteDance’s $1 billion acquisition of Musical.ly, arguing that “Chinese-owned apps are increasingly being used to censor content.” The USA’s Committee on Foreign Investment has begun a national security review into the deal.

Concerns about data are bleeding into other countries. The Netherlands is conducting an investigation into the way TikTok handles children’s content; mounting pressure from Indian MPs has the company moving to store data locally instead.

Anti-Chinese, pro-local sentiment

In some countries, ByteDance’s main obstacle is anti-Chinese sentiment and a strong push for local alternatives. This is still the case in India, where Mitron—an Indian-made TikTok clone—gained 5 million downloads within just one month of its launch.

IIT Roorkee student has quietly released a Tiktok clone called “Mitron TV” a month back and it has not only achieved 5mn installs, it is now no.2 android app in India thus raking in half a million installs per day. Name of the app is the growth hack here IMO pic.twitter.com/z24YtNOwJr

— Deepak Abbot (@deepakabbot) May 25, 2020

Other countries are taking a different approach. Indonesia’s president reportedly told the country’s Agency for Pancasila Ideology Education (BPIP) to promote the values of the state ideology, Pancasila, through TikTok. (Many Indonesians began to view the app in a more positive light after Indonesian song “Lathi” became a viral meme, gaining over 25 million views on the original video).

And the Vietnamese government’s catchy hand-washing PSA song sparked a global dance challenge under the #vudieuruatay hashtag, even catching the attention of American comedian John Oliver.

In Southeast Asia, TikTok has tended to market itself as a facilitator for cultural exportation, so it avoids the criticism and negative sentiment it’s encountered in countries like the USA. In fact, it’s been greeted with open arms in the region (save for a week-long ban in Indonesia back in 2018). Elsewhere, Mayer’s presence on the team may help Western countries view ByteDance in a more positive light.

These obstacles are by no means insurmountable. We believe that, with ByteDance’s dedication to innovation (and the sheer size of its userbase), it will be able to make relatively easy work of these hurdles.

Manifesting its destiny as a major tech giant, for better or worse

ByteDance generated $17 billion in revenue for 2019 (compared to just $7.4 billion in 2018) and pulled in $3 billion in profits. Compared to other well-known giants it’s doing very well—last year, Twitter reported a net income of $1.47 billion last year, and Snapchat reported a net loss.

The company is currently sitting on at least US$6 billion in cash, and Bloomberg analysts expect the company to reach a market value of US$150 billion to US$180 billion in an initial public offering.

Given its experience in AI-powered algorithmic recommendation systems and robust data analysis capabilities, ByteDance seems to be well-poised to serve as the bridge between users and the corporations and organizations that seek their attention. Rather than forcing an external framework onto users or making assumptions about what will and won’t work, ByteDance’s MO is to stalk its audience and become an irreplaceable part of their lives.

If the company can prove the efficacy of its moderation algorithm and overcome anti-China sentiment in its target markets, the company will be unstoppable. And it seems like it’s just a matter of when.