A warm welcome to the Deeper newsletter, dear reader!

You’re reading this because, just like us, you’re tired of the non-stop tech and startup news cycle, where there seems to be something new and trendy to keep up with in Southeast Asia.

What you want to know about is the important stuff that matters—period.

And that’s what we’re bringing to you. We’ll dive deep into a trending topic in Southeast Asian tech, and their impact on society (i.e. me and you).

Sound compelling? Subscribe now, and we’ll send it straight to your inbox:

Without further ado, let’s dive in.

Hurtling faster towards a world full of better businesses

The pandemic has forced all of us to change. Now that so many of us are stuck at home, we’ve become increasingly reliant on our phones to get the products we need. In response to shifting consumer behavior, businesses have developed new features at the speed of light and shifted their strategies to win over millions of new users.

The rise of—and war between—ecommerce platforms during COVID-19 to innovate and woo customers is one of the effects caused by region-wide shifts in consumer behavior.

Ecommerce platforms like Shopee, Tokopedia, and Lazada are becoming even more customer-obsessed as more and more buyers get online through their mobile phones, and businesses across all industries will need to follow suit.

TL;DR: The COVID-19 pandemic has required businesses of all kinds to adopt a customer-centric approach and to truly empathize with their buyers to develop features and products that truly benefit them.

- An increasingly large middle class is developing new buying habits

- Ecommerce platforms are leading and driving business innovation in Southeast Asia

- The power—and fickleness—of a growing middle class

- Now more than ever, you need a customer-focused approach to succeed

- A faster, more agile future

These changes signal a brighter future where brands will become more active partners in their customers’ journey for well-being and satisfaction.

An increasingly large middle class is developing new buying habits

On the whole, ASEAN consumers are gaining more disposable income and getting better phones and Internet service, giving rise to a ballooning middle class. One report says that there will be over 50 million new consumers across Indonesia, Malaysia, the Philippines, Thailand and Vietnam by 2022 with a collective $300 billion middle-class disposable income.

And according to Bain & Company report titled “Riding the Digital Wave: Southeast Asia’s Discovery Generation”, there will be over 310 million digital consumers in the region by 2025—compared to 250 million in 2018 and 90 million in 2015.

Though COVID-19 has “interrupted ASEAN’s path to middle-income status”, World Economic Forum analysts explain that “the long-term fundamentals of the ten Association of Southeast Asian Nations (ASEAN) member states are on the cusp of a tremendous leap forward in socio-economic progress.” Over the next decade, the region is expected to reach a US$4 trillion consumer market to become the world’s fourth largest economy. If anything, the pandemic has accelerated the consumer trend towards digitalization and online markets and products.

What will ASEAN’s new emerging middle class market do? Buy stuff. And businesses in the region will naturally evolve to target and please these new markets.

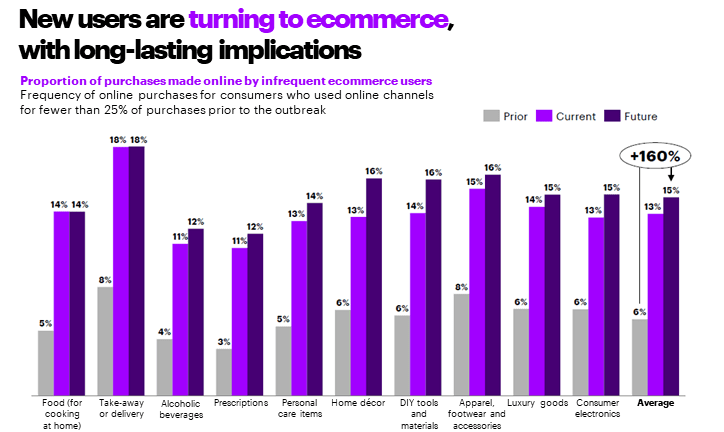

This shift to a consumer-focused approach is being spearheaded by ecommerce platforms. Thousands of thousands of people turning to ecommerce platforms to get the necessities—medicine, groceries, low-value household items—they need. And in response, platforms are churning out feature after feature in a bid to find the right combination of tactics that will woo and retain users.

Ecommerce platforms are leading and driving business innovation in Southeast Asia

Ecommerce has been big for a while now in Southeast Asia. Five out of six Southeast Asian unicorns are ecommerce related:

- Tokopedia

- Sea (formerly Garena)

- Lazada

- Grab

- GoJek

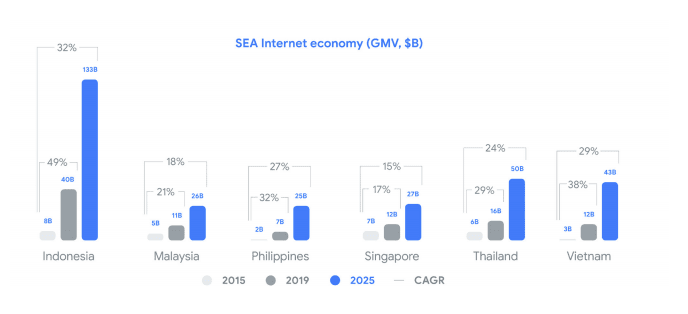

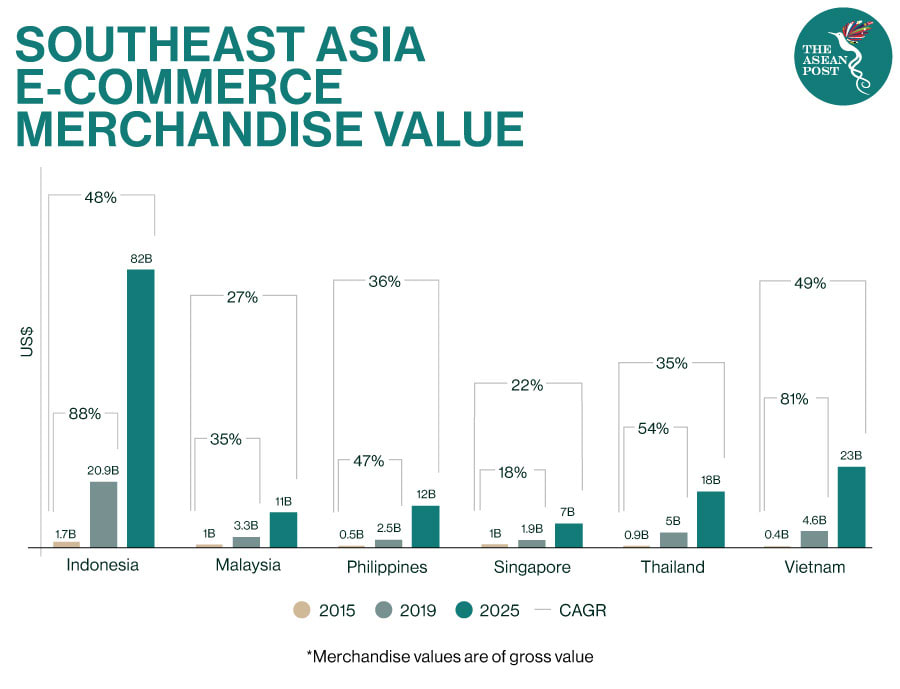

And ASEAN ecommerce is a highly vibrant, interesting sector. Back in 2015, the regional ecommerce sector amounted to just US$5.5 billion in value. In 2017, ecommerce platforms accounted for nearly US$11 billion in gross merchandise value. This amount more than doubled again in the next year, exceeding US$23 billion in 2018. If you do the math, that’s a 62% compound annual growth rate (CAGR) over four years.

An oft-cited joint report from Google and Temasek reports that Southeast Asia’s internet economy will surpass US$240 billion in worth by 2025, with ecommerce making up US$102 billion—or over 40%—of the internet economy’s total worth. (Those numbers may be even higher by the time the next report rolls around).

Last year, Shopee counted around 30 million downloads in the Philippines and nearly 500,000 active sellers on the platform. In Indonesia, Tokopedia’s 2019 GMV hit US$15.6 billion, equivalent to an entire 1.5% of Indonesian GDP.

Lazada’s 2019 11.11 Singles Day Sale—held in Singapore, Malaysia, Thailand, Indonesia, the Philippines and Vietnam—hosted over 20 million cumulative shoppers. Lazada Malaysia explained that they surpassed their 2017 sales numbers just nine hours into the campaign, with a peak of 3,000 transactions per minute.

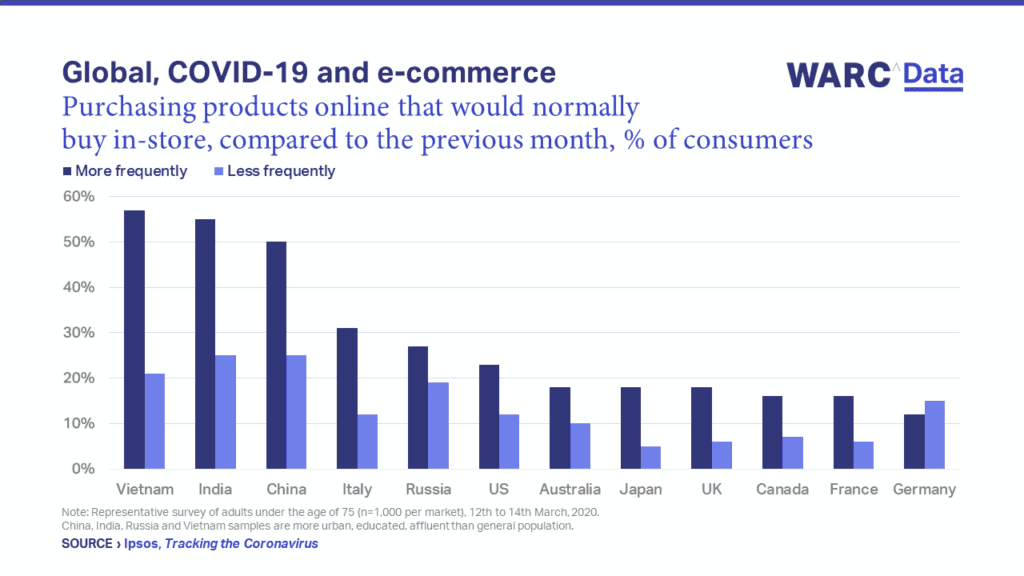

Why go out when you can stay at home and buy everything (and anything)?

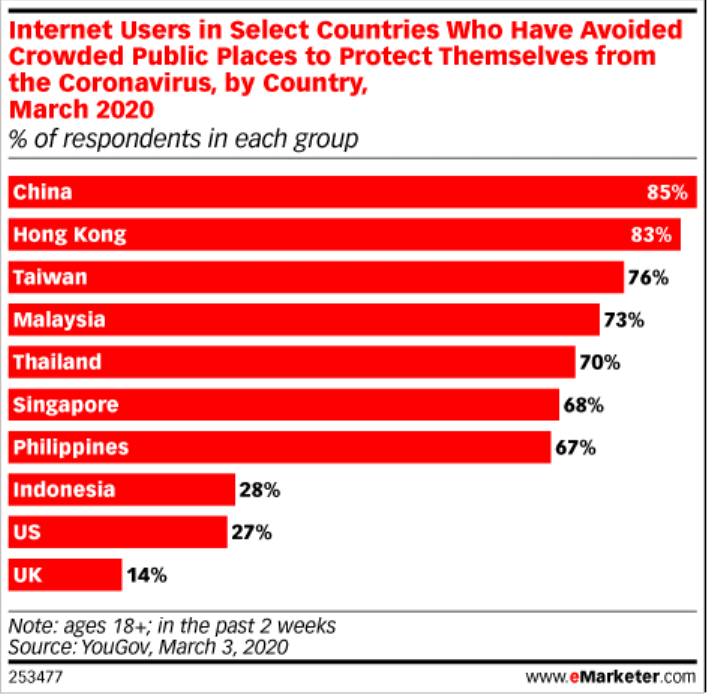

With stories about how frightening COVID-19 symptoms and treatments are, it’s no wonder people are preferring to shop ‘til they drop—from home. In India, nearly six in 10 consumers are avoiding stores out of fears of infection. This is mirrored around the world. According to the research firm Technomic, 52% of global consumers are avoiding crowds and 32% are leaving their house less often thanks to the pandemic.

And Asian citizens are especially risk-adverse (with the exception of Indonesia…):

Thanks to the forced quarantines and lockdowns, consumers are spending significantly more time on their phones—worldwide, smartphone and mobile phone usage increased by 70%—and many of them have turned to online shopping for comfort.

- Global retail platforms have seen an average 6% global traffic increase between January and March 2020. Overall, retail websites generated 14.34 billion visits in March 2020, up from 12.81 billion global visits in January 2020.

- B2B, the local arm of China-based Alibaba, boasted over 10.2 million page visits in February 2020; Singapore-based Shopee recorded 1 million.

- In Indonesia, management consulting company Redseer stated that 30% of respondents to their ecommerce survey said that the pandemic period was the first time they’d ever tried out online marketplaces; 40% of that slice said they’d continue using ecommerce even after the outbreak was over.

The power—and fickleness—of a growing middle class

Competition between the big ecommerce companies has been neck-and-neck for a while now, and there’s been a lot of growth during COVID-19 countermeasures. But not all platforms have found success during the pandemic.

In fact, iPrice Group recently released a report revealing that three out of four ecommerce platforms in Vietnam—Tiki, Lazada Vietnam, and Sendo—saw an average 9% drop in website traffic throughout Q1 2020.

According to iPrice Group analysts, the reason for this drop was this: these platforms couldn’t keep up with fast-changing trends and unpredictable, ever-shifting demands of consumers. At first, when COVID-19 first appeared, demand for hygiene products such as face masks and hand sanitizers shot up significantly. But as the months passed, online groceries became more and more sought out, and ecommerce platforms in Vietnam were not prepared for this need.

Fortunately, online groceries have popped up in Vietnam and elsewhere to deliver fresh fruits and veggies to buyers. Before the pandemic began, online grocery delivery was an underpenetrated market—but the sector has since grown nearly 300% this year. Among this year’s grocery buyers, at least 80% stated that they’d continue purchasing groceries online even after the pandemic has cleared up.

But change is now inevitable, and ecommerce platforms must laser in on their consumers’ needs in order to survive

The changes in consumer behavior—namely, the increasing reliance on digital platforms to get products they need and their determination to get it from the best source—is almost certainly going to stay for good.

What this means for businesses is that there probably will never be a full return to “normal” or the old way of doing things. It will be impossible for businesses to go back to offline-only methods; this coming decade is all about delivering omni-channel experiences to customers and beating competitors at user experience and satisfaction.

The shift to online life is already happening, especially now that companies are releasing more and more options and features designed to make their user experience as complete and comprehensive as possible. Consumers have a lot of power to bend companies to their wills now, as evidenced by the Vietnamese ecommerce platforms’ failure to take advantage of the opportunities in COVID-19.

Consumer wants are always changing, and as a result tech businesses are still struggling to define their roles in the marketplace—most of the unicorns have their fingers in many, many pies, from digital payments to food delivery to ecommerce to travel bookings.

Tech giants are going through an identity crisis in their efforts to appeal to an increasingly agile and mobile consumer market

Lazada subsidary Redmart (online grocery store) saw a huge influx of orders during COVID-19, and the platform had to suspend new orders from April 2 to April 4 due to a massive increase in demand. Lazada launched an initiative in Indonesia to sell fresh produce supplied by thousands of farmers in West Java.

Around the same time, Shopee Indonesia and Tokopedia also began piloting ready-to-eat delivery services on their platform, putting them in competition with GrabFood and GoFood.

Ecommerce platforms will continue to grow (and in some cases, compete) in tandem with the logistics platforms that power their deliveries—both ride-hailing ones like Grab and Go-Jek, and last-mile logistics like Ninja Van or J&T. As retail platforms expand and fight for leadership, ASEAN consumers will be able to enjoy the benefits: more choices, more value, and more convenience.

We can already see that ecommerce platforms are trying to either build their own delivery fleets or partner with local logistics companies to bring same-day delivery to every corner of every nation they’re operating in. Expect to see even more expansion from larger cities to smaller and smaller villages; more experimentation with business verticals; more small-scale “experiments” and tests as companies try to tease out the most significant customer demands.

Now more than ever, you need a customer-focused experience to succeed

The changes that COVID-19 is foisting upon ecommerce platforms—bigger, better, faster, more flexible¸—are applicable no matter what kind of company you’re running.

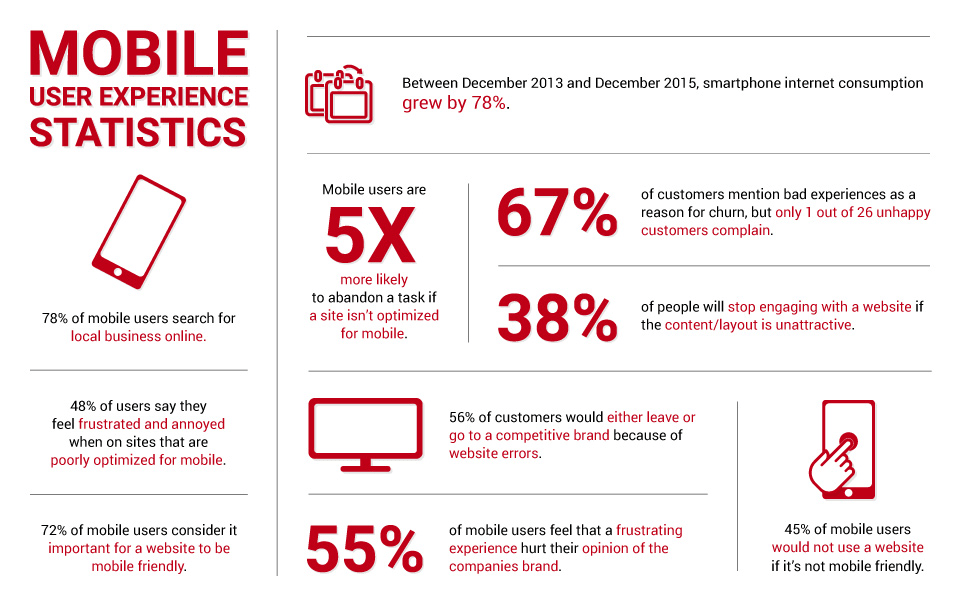

Now that more and more users are connecting with mobile phones, businesses and organizations will need to prioritize an enjoyable, lightweight mobile experience—according to the PYMNTS’ 2020 Remote Payments Study, 72% of consumers are using mobile devices to shop for products.

Please customers with great mobile experiences

Millions of consumers stuck at home are spending more time on their mobile phones. They are developing new online buying behaviors and browsing habits. The massive increase in the number of users looking for entertainment and necessities from their phones is an ideal opportunity for companies to split-test, develop new features, and perfect their online experiences, mobile apps, websites, and omni-channel consumer touchpoints.

Stop skimping on security

As you develop your mobile presence and create promotions, new pricing, and new online systems for interacting with customers, you will collect more and more consumer data. This is vital stuff that you need to protect if you want consumers to keep coming to you.

One solution to look into is AI-algorithm and machine-learning-based cybersecurity. These types of systems track user types, device specifics, IP risks, and millions of other data points to develop a smart bird’s eye view of your ecosystem.

AI algorithms can understand patterns of failed login attempts and fraudulent behavior much faster than humans can; applying them to your own tech stack can help improve user experience by banishing friction from the signup, onboarding, and purchasing processes.

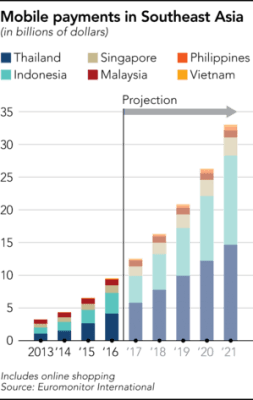

Get digital and contactless payments if you haven’t already

The pandemic isn’t just changing the way consumers shop. It’s also changing how they pay for their products. Contactless payments have increased online and offline as buyers seek to avoid exchanging cash; ecommerce platforms have also taken the opportunity to push their own proprietary e-wallets.

In the Philippines, for example, ecommerce and digital payments platforms had encountered difficulty gaining traction prior to COVID-19. Philippines is still heavily cash-based, and many necessities are bought from small sundries shops called sari-sari stores.

During the pandemic, however, payment aggregator companies and digitalization solution platforms Posible and True Money reported that they saw double-digit growth in transaction volume. These companies provide point-of-sale devices to sari-sari stores so they can process financial services like bill payments, e-wallet top-ups and local remittances.

And GCash, which is currently the country’s largest digital payments solution (it’s backed by China’s largest fintech firm, Ant Financial) experienced similar growth. Reportedly, the e-wallet has enjoyed “double-digit” growth in new user sign-ups across all age groups since the quarantine period began in early April.

The pandemic is inducing a major shift in consumer habits across the entire region, and there’s hope that one day we may be as connected as China, leaping straight from a cash-based society to a cashless one.

Get the data

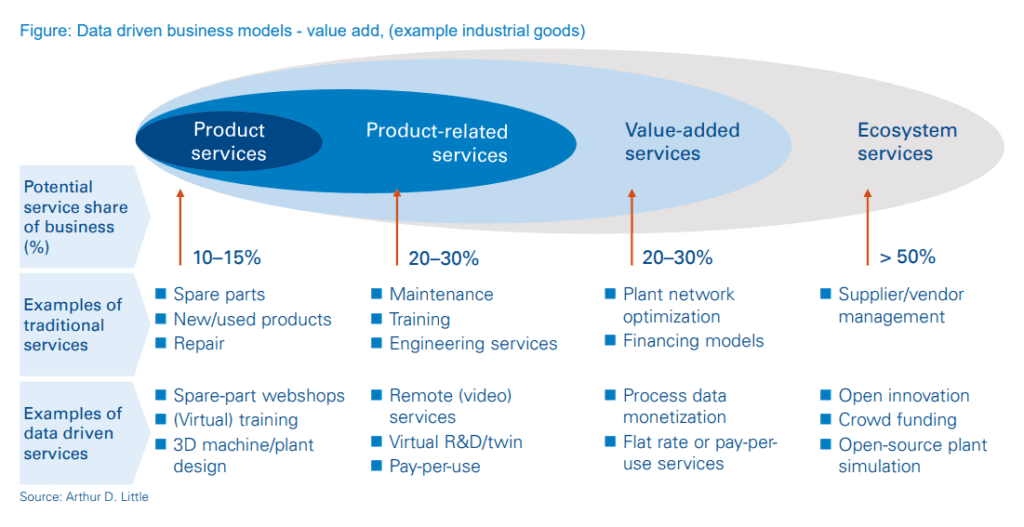

We talked about data aggregation in a previous edition of Deeper—mainly, about how TikTok was able to establish dominance by collecting and analyzing thousands of bytes of data to deliver the most viral, interesting content. Data analysis will be a major boon in the future for companies from all industries.

According to a 2019 Bain & Company report, 67% of respondents said they do not know exactly what they want to purchase before they shop online. However, over 40% of respondents have tried an online store they have never heard of before. And in Singapore alone, 75% respondents said they are open to buying from new or multiple brands when shopping online.

This means that buyers are interested in product discovery, and to differentiate, companies should develop the ability to deliver relevant, timely purchase recommendations. This isn’t just about helping consumers buy what they need, but about showing them amazing stuff they didn’t even know they wanted. Knowing your customers better than your competitors is what will help you stand out.

A faster, more agile future

It sometimes seems like every industry is tossing around the same buzzwords these days: speed, agility, customer-centric, modularity, flexibility, and so on and so forth. Though they seem a bit stale after you hear them so many times, they truly are relevant: companies who adopt digitalization concepts and focus on speed and customer experience make more money and earn more customer loyalty.

As a business, one of your main prerogatives is to make money. You can’t survive without it. But we believe that there’s a lot of hope for the business ecosystem of the future. Brands are becoming more empathetic and more keyed-in to their consumers needs and hopes—take Philips, for example, which transitioned a few years ago from a simple consumer electronics brand to a company sincerely dedicated to helping and saving the lives of their customers.

In the future, expect a roiling ocean of near-constant updates and shifts in your industry, whether that’s tech or marketing or advertising or manufacturing. Gone are the days when you could take months or years to plan out a product or campaign; you need to iterate quickly if you want to keep up with the market. Be obsessed with your customers. Track data (ethically). Build real relationships with them.

In this all-out battle for market share, it’s heartening to know that there’s a future ahead where consumers can better enjoy and access the products they need—and where companies can take a step forward to become a little bit more human.

<

p style=”text-align: center;”>P.S. Like what you read? Get articles like this in your inbox.