A warm welcome to the Deeper newsletter, dear reader!

You’re reading this because, just like us, you’re tired of the non-stop tech and startup news cycle, where there seems to be something new and trendy to keep up with in Southeast Asia.

What you want to know about is the important stuff that matters—period.

And that’s what we’re bringing to you. We’ll dive deep into a trending topic in Southeast Asian tech, and their impact on society (i.e. me and you).

Sound compelling? Subscribe now, and we’ll send it straight to your inbox:

Without further ado, let’s dive in.

According to Bain & Co, more than seven out of 10 adults in Southeast Asia are unbanked or underbanked, meaning their financial needs are not well-served. They may not have a credit card, live without a long-term savings account, or have little to no emergency funds. In fact, they may not have access to a bank account at all.

Even in Singapore, one of Southeast Asia’s sterling business hubs, four out of 10 people are underbanked.

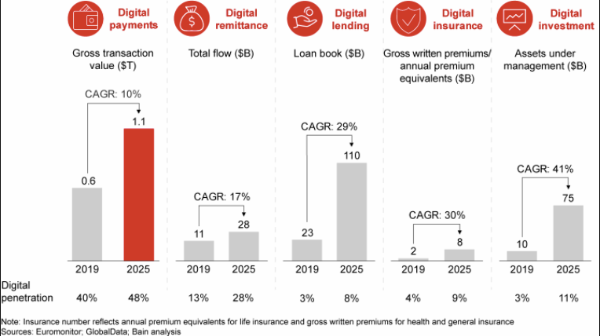

In response to this gap, the digital financial services industry is expected to generate about US$38 billion by 2025, with online lending making up about half of that opportunity. Online lending is also expected to grow the second-most out of all fintech categories by 2025, and that’s where we’ll be zooming in today.

These personal loans have become incredibly popular in recent years, allowing people to access funds for anything from purchasing a new phone to paying for their children’s education. But not all loan apps are made equal, and it will be more important to regulate and monitor these services to ensure they don’t become predatory.

TL;DR: Online lending apps can be incredibly helpful in increasing financial accessibility for millions, but left unchecked, may end up doing more damage by leaving a new generation of users in debt and harming their own dreams for success.

- It’s now easier than ever to get a micro-loan in less than fifteen minutes

- The allure of easy money is too tempting for many in need

- Differentiating between well-intentioned fintech startups and those looking for quick gains

- Where are governments throughout all this?

- Increased demand and popularity requires better due diligence—supported by big data, machine learning, and centralized databases

- What could the future look like?

It’s now easier than ever to get a micro-loan in less than fifteen minutes

There are plenty of online lending apps in Southeast Asian markets. Indonesia is arguably one of the most advanced payday loans markets, with major players like Kredivo and Akulaku leading the way. This makes a lot of sense to us, considering Indonesia has the most mobile users in the region and the most passionate ecommerce spenders—according to Statista, Indonesia could account for over 50% of the Southeast Asian e-commerce market by 2025.

Proving this online loan trend are ecommerce apps like Tokopedia, Traveloka, and Shopee, which are all releasing their own versions of in-app credit options that allow buyers to pay in installments.

The sign-up requirements for these accounts vary, but most are simple. ShopeePayLater, for example, only requests a selfie with a national ID card—the Kartu Tanda Penduduk (KTP)—for Indonesian nationals to begin buying items on a Rp. 750,000 to 1,800,800 (S$75-180) credit line.

Buyers can purchase items and pay for them five months later with a 0% interest rate, or pay in installments. Buyers will pay their installment on the 25th of each month; if they’re late, they will be charged an additional 5% fee from their outstanding ShopeePayLater balance.

Kredivo, which boasts a 4.5 star rating on Google Play (from over 700,000 reviewers), advertises a 2.6% per month interest rate (and an admin fee of 6%), or a maximum annual rate of 53.36%, for 3, 6, or 12-month installments. They explain, “If you choose a 12-month installment to pay a transaction worth Rp. 1,000,000 Kredivo charges an interest rate of 2.6% per month. The repayment amount that must be made per month is Rp. 109,340 and the total payment after a year is Rp. 1,312,080.”

To make a Kredivo account, borrowers must be Indonesian nationals between 0 and 60 years of age living in one of several major Indonesian cities. You must also have a minimum income of Rp. 3,000,000 per month, have proof of domicile, and link your bank account and/or national tax ID to get a credit line of up to Rp. 30,000,000 (S$3,000).

Many countries in Southeast Asia do not have a centralized credit history system or reporting system for their citizens which businesses can access. This presents a unique challenge for fintech startups, which have to determine their own ways to measure borrower’s creditworthiness. They seem to be doing well so far—Akulaku has reportedly managed to keep the defaulting rate below 3%, even after the Covid-19 pandemic.

Startups have attempted to release similar products in other countries, such as Singapore. Grab, for example, released a “cash advance” program that allows workers to receive projected earnings after paying a one-time administrative fee, but to many, this seemed like a glorified payday loan option—similar to the types of products now rampant in Indonesia.

As of May 2020, Indonesia’s OJK—Otoritas Jasa Keuangan, or Financial Services Authority in English—reports that across the collective 161 registered fintech platforms currently operating in Indonesia, the average default rate is now 5.1%. Fintech platforms don’t often transparently share or update their default rates on their websites, and it is not clear how many of these self-reported numbers are to be trusted.

Information needs to be shared more transparently and freely across startups and countries, and reporting standardized across companies. This would help startups get the information they need to better verify users, and it would also prevent potential abuse and predation of or by financial service systems.

So far, the rise of fast online loan apps has mainly been an Indonesian problem—but there is a chance that the trend will spread to other countries. It is critical for other countries to keep a close eye on Indonesia’s situation and proactively publish regulation for digital financial services in their own countries.

The allure of easy money is too tempting for many in need

Desperate consumers are often willing to turn to any option available to get the money they need. This doesn’t necessarily mean that lenders should give it to them, especially if they probably can’t pay it back.

The Straits Times reports that, in India, online lenders charge 25% to 40% annual interest (banks, in comparison, charge 12% to 20%). And though their websites promised a repayment tenure of up to 90 months, e-mails and screenshots from borrowers showed that many only gave their borrowers 15 days or less to return the money.

A lot of these apps require borrowers to give as much information as possible under the guise of “verification”. This even includes access to contact books and call logs…all of which come back to bite borrowers when it comes time to pay loans. Should lenders be unable to pay on time, third-party debt collectors will use any and every tactic necessary to get money back—including socially shaming lenders by letting friends and family members know about their unpaid debt.

Differentiating between well-intentioned fintech startups and those looking for quick gains

Though micro-loan and fintech startups may present a sleek, glossy image, this doesn’t necessarily make their processes any more elegant or refined than their traditional counterparts. This is a major problem in Indonesia, where news reports of frightening debt collectors sent from fintech startups abound—even from those with the best reputations, such as Akulaku and Kredivo.

These debt collectors will go to lenders’ homes, workplaces, and even schools to gather the debt they are owed. Some send frightening text messages, others turn to violence, and some even threaten to leak private sexual images.

Though the OJK has released statements requesting that fintech lenders not employ debt collectors in this manner, reports of harassment and violence from startup-employed debt collectors continue to be lodged to this day.

This is also the case in India, where Chinese-owned fintech and personal loan apps have reportedly turned to harassment or physical violence in order to get their money back.

Where are governments throughout all this?

Most countries have experienced difficulty trying to regulate fintech companies. Many of these startups don’t just operate in fintech, after all—take Shopee and Traveloka, for example, which are ecommerce and online travel booking platforms, respectively.

Because many of these startups haven’t positioned themselves as banks, they haven’t been scrutinized or held to the same standard as banks, and they are governed by different rules.

OJK, founded in 2011, currently oversees P2P Lending, crowdfunding, digital banking, data security, and insurtech startups, as well as consumer protection in Indonesia. The fintech sector in Indonesia is booming because so many people need access to financial services, and so far, the OJK has been doing a good job of cracking down on fraudulent or predatory fintech companies. But many manage to slip past by operating under the table, fleecing customers who don’t know to avoid unapproved financial service companies.

On top of this, many of these startups wrap their services in pretty UI/UX interfaces, promising modernity and civility to consumers who often assume that they’re trustworthy simply because they’re available on the App Store or Play Store.

Though there are many startups seeking to bring digital financial services and do good for the underbanked, there are just as many masquerading under the “fintech” banner while actually seeking to skirt past regulations and con people with promises of fast loans.

In India, for example, foreign lending apps partner with licensed local financial partners, so the Reserve Bank of India (RBI) does not closely scrutinize their entry into the market. This means that sometimes, the only barriers to these apps and the low-income citizens they prey upon are whether or not they can get published in the Google Play Store and App Store.

Though the RBI’s fair practices code warns against “inappropriate behavior towards borrowers, “abusive or coercive debt collection and recovery practices”, penalties on late payments, and invasion of privacy, it is difficult to police such tactics. On June 25th, India’s bank responded to consumer complaints about these frightening collection methods by announcing tighter rules for digital lending platforms.

Now, apps have to disclose the names of their partners and adhere to fairer practices. But it’s still too soon to tell whether these new rules will improve the situation.

Every Southeast Asian government is on the lookout for the next unicorn, and for successful startups that can attract more investor money—and we don’t wonder if this allure is one of the reasons consequences have not been dealt as quickly as they should be.

Are governing bodies being lax about the violent or underhanded methods startups are using to collect their money out of fears of “killing” a potential unicorn? After all, reports about debt collectors from fintech companies have poured in since 2018 and earlier, even against highly-respected apps like Kredivo and Akulaku, but no significant punishment or sanction has been handed down.

But this suspicion may be too pessimistic. Considering the size of the fintech market, this may simply be a matter of not having the manpower and scope to identify the worst violators until they make major missteps. Seven-year-old financial advisor and investment management company Jouska, for example, boasted nearly a million followers and hundreds of clients before very recent reports of scams and lost money caused OJK to shut the operation down just a week ago.

Governments in Southeast Asia should tread more carefully when it comes to fintech, especially if they cannot help or protect borrowers who get into trouble. Borrowers have little recourse when it comes to seeking protection, especially because the judiciary system is rarely prepared to tackle crimes or danger of an online nature. There needs to be even clearer delineations and rules regarding the myriad types of online financial services that will arise in the future—from digital banking, to online loans, to P2P lending platforms, to investment managements and mutual funds, and more.

Increased demand and popularity requires better due diligence—supported by big data, machine learning, and centralized databases

Finance is a sensitive and difficult topic. Though many begin with noble causes—to bring financial services to underserved masses and communities—at the end of the day, they are still businesses. Businesses must cover their bottom lines and make enough money to operate. This leaves many modern fintech startups scrambling to achieve critical mass in any means possible, including approving debtors who aren’t exactly trustworthy or failing to do due diligence.

There’s a reason it’s harder to get a loan from a bank. They’re aware of the risks that come when people are unable to pay their debts. Startups should be wary of being too lax in their endeavor to be more accommodating, more helpful, and more understanding of big, bad traditional finance institutions.

Being too friendly with irresponsible—or even fraudulent—borrowers is also painful in the long run for startups. If they are too focused on growing their base, they may forget to use sustainable methods, and that will result in a cash-burning race to death as they struggle to recoup their funds.

Startups are tackling the issue of verification in a variety of ways. The AsiaKredit/pera247 platform, recently acquired by fintech firm GoBear, claims to provide the shortest real-time credit decision on the market. This is done by “extracting data points from both traditional and alternative sources of data, such as behavioural mobile data from an applicant’s smartphone”.

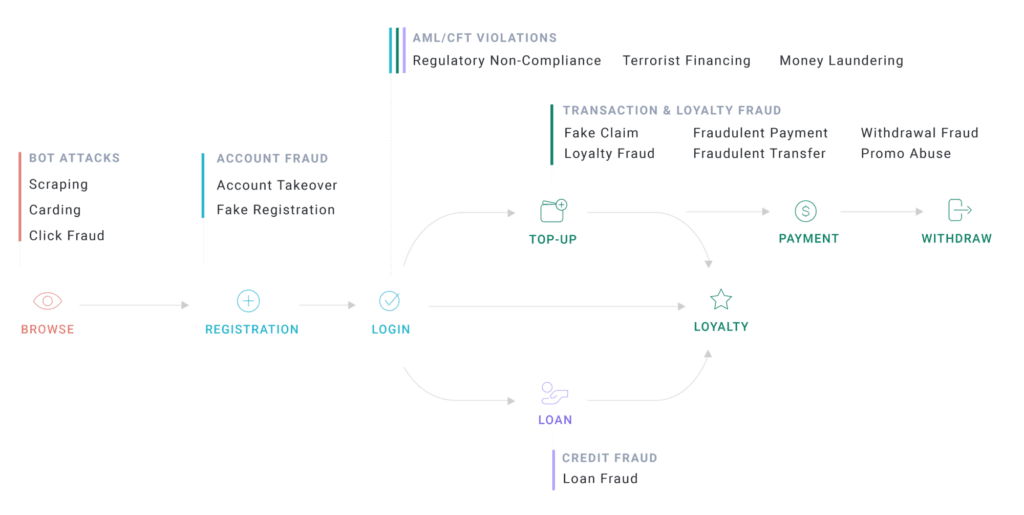

Some fintech companies invest in the development of their own security and verification tools. Others turn to third-party solutions such as SHIELD, one of the biggest AI-powered fraud detection engine companies in Southeast Asia:

Fintech companies do claim to carry out risk assessments before approving users, but because there is no standardized credit assessment and review system, it is left up to their own discretion and there is no transparency into the different verification methods used by different startups, or their resulting approval rates.

This lack of a standardized system also makes it nearly impossible to verify whether or not a potential user has applied or is currently active on other financial platforms (leading to situations like the borrower who successfully borrowed from 100+ different lenders).

Consumer verification has become exceptionally important in the wake of Covid-19. According to Tech in Asia, consumer lending platforms such as Kredivo, UangTeman, and Akulaku have all reported a drastically increased number of applications to their platforms.

A representative from UangTeman said, “The number of applicants on our platform has increased 40%. We’re lucky that we have implemented a tight credit analysis process with an AI machine, so our approval rate is only 20%.”

What could the future look like?

Southeast Asia’s finance system has much to gain from the development of digital finance services. A more unified financial sphere built on digital verification tools and identity-checks could go a long way in building a more inclusive region, especially since smartphone penetration and engagement is higher than ever.

This could really bring good for so many people, and empower so many families—Wavemaker’s Canal Circle is a great example of the good digitalization can bring to finance.

It will be increasingly important for fintech companies to invest in risk management and anti-fraud measures. We will also need to push governments and financial authorities to better-educate people about the dangers of these platforms if used incorrectly, and strengthen consequences for those who violate the rules (without resorting to violence or debt collectors).

William Li, CEO of Akulaku, shared, “Every transaction involves risk control, KYC and anti-fraud—such calculations are simply beyond human capacity. We must rely on technology, which is why our investment in research and development exceeds US$28 million every year,” Li said.”

We hope to see the development of more open, friendly, and firm regulatory policies that can safeguard the development of fintech services. Ideally, consistent and transparent regulations across countries and regions can help guide a new generation of startups to bring access to financial services to the corners of all Southeast Asian nations.